16+ Private mortgage

Dont get caught off guard. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

The Money Multiplier Video Series Infinite Banking Concept Education

As mentioned earlier PMI is an added cost on a conventional loan if you pay less than 20 on your mortgage.

. Interest rate relates to the cost of borrowing stated as a percentage on the principal amount of a mortgage. 30-year fixed mortgage rates. Mortgage company or other financial institution for the purchase of a primary or investment residence.

Interest rates and annual percentage rates APR are two different ways of expressing the fees a borrower incurs when taking out a mortgage. Real estate California power prices soar to highest since 2020. Rail Deal Sep 16 2022.

On a 15-year fixed mortgage the average rate is 494. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. The current average 30-year fixed mortgage rate is 602 according to Freddie.

Eliminates private mortgage insurance PMI. Home buyer programs by state. For prepayment penalty calculators and interest rates please refer to your annual mortgage statement which includes details on where to find this information.

Rail-Strike Ethereum Sep 15. However agreements are required for Fannie Mae and VA loans. 16 of 33.

Consider two individuals who each want to buy a home valued 100000 and can each put down 10000 or 10 of the value of the. Consider paying 20 down to avoid this extra fee. Paradigm Quest Inc 390 Bay Street Suite 1800 Toronto ON M5H 2Y2.

The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac. Use the Calculator A Guide for the First-Time Buyer Learn to negotiate save on your mortgage and pick the perfect location. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

The Ellington Income Opportunities Fund is a continuously offered non-diversified closed-end investment management company operating as an interval fundThe Fund seeks to capitalize on the broad opportunity set spanning mortgage real estate consumer credit and corporate sectors in both the public and private markets. Freddie Mac and FHA loans typically do not require a private road maintenance agreement. Your FHA loans annual MIP will remain for the life of the loan unless you put more than 10 percent down.

Click More details for tips on how to save money on your mortgage in the long run. Many homeowners must pay private mortgage insurance as part of their monthly mortgage payment. This is the rate the.

Get the Guide Get Started Careers Contact Us. Compare and see which option is better for you after interest fees and rates. See the monthly cost on a 250000 mortgage over 15- or 30-years.

Switching mortgage products late in the process can halt your closing date or cost you more in closing costs. Here is an example of how factors such as creditworthiness impact the cost of mortgage insurance. Everything you need to know about Private Mortgage Insurance.

Use our mortgage calculator to get an estimate of your monthly payment. In that case the premium goes away after 11 years. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

How Credit Scores Affect the Cost of PMI. A mortgage is a debt instrument secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments. Credit scores dont just affect mortgage and homeowners insurance rates they also affect PMIS.

Best Bank Loans of September 2022. What is the difference between interest rate and APR on a mortgage. The average rate on a 30-year jumbo mortgage is 5.

Best Small Personal Loans. Conventional loans will not require private mortgage insurance PMI if you have at least 20 percent in home equity. You can also refinance into a conventional loan to eliminate MIP.

First Look With Surveillance. Lenders mortgage insurance LMI also known as private mortgage insurance PMI in the US is insurance payable to a lender or trustee for a pool of securities that may be required when taking out a mortgage loanIt is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale of the. USDA loans are determined on a case-by-case basis.

Invest In Private Hard Money Loans

Christian Gilhuly Mortgage Lenders Old National Bank

Q Haus Prefab Houses Qhaus Twitter

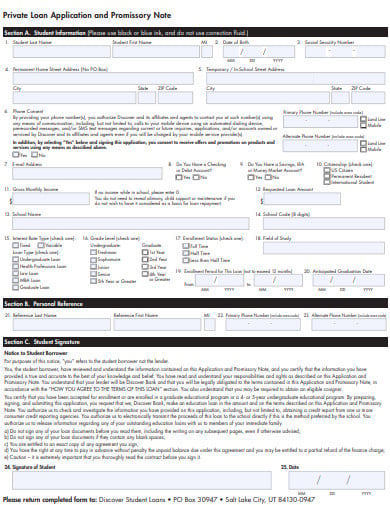

Lending Money Contract Template Free Fresh 4 Money Loan Contractreport Template Document Contract Template Marketing Plan Template Templates

How To Get A Personal Loan Best Ways To Apply And Get Approved

43 Sample Loan Agreements In Pdf Ms Word Excel

Invest In Private Hard Money Loans

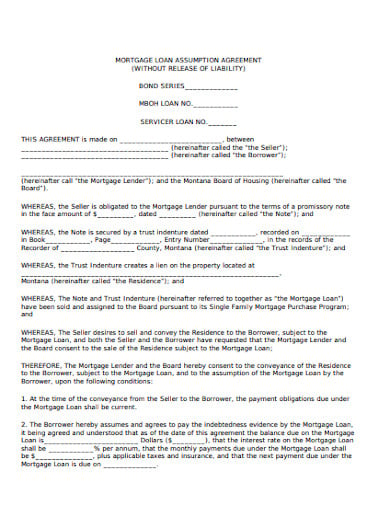

Free 16 Mortgage Agreement Contract Samples Templates In Pdf Ms Word

16 Loan Note Templates In Pdf Free Premium Templates

Free 16 Mortgage Agreement Contract Samples Templates In Pdf Ms Word

Invest In Private Hard Money Loans

16 Loan Note Templates In Pdf Free Premium Templates

Q Haus Prefab Houses Qhaus Twitter

11 Mortgage Agreement Templates In Pdf Doc Free Premium Templates

Invest In Private Hard Money Loans

16 Loan Note Templates In Pdf Free Premium Templates

499 Dancing Deer Drive Eastsound Wa 98245 Compass